Introduction

The outlook for the global economy and financial markets looks more uncertain today than it has for a long time. Both interest rates and inflation have risen sharply. There is a growing consensus that much of the world will shortly be experiencing slowing economic growth.

Understandably, investors are asking what their options are. With a wide array of asset classes available, which are best placed to offer investors resilience in the current environment, but also as a sustainable investment option for the long term?

For investors seeking the opportunity of reliable income flows in addition to capital appreciation, property has historically, and likely will continue to be, a prime focus. In this paper the principal attractions and avenues for investment into the asset class will be examined and the case made that now is an attractive point for investors to consider listed property.

Further, the ‘why now’ case for listed real estate is bolstered by recent sharp sell-offs in the sector creating clear dislocations with core private real estate funds. This relationship will be examined in this paper as we highlight the investment opportunity in listed property, as both a compliment and a preference to property as an investment.

'Recent sell-offs in the sector have created clear dislocations'

Investment considerations

Before considering the investment merits, it is worthwhile considering the two main routes into property investment: listed property (REIT’s) or private real estate (unlisted property funds). There are pros and cons for both with the main differences relating to liquidity and flexibility. The key characteristics of both are:

Unlisted/private property

- Lower correlation with equities and REITs in the short term and higher correlation to REITs in the long term

- Valuations based on Net Asset Value rather than the stock market

- Liquidity:

- Closed end private property funds: inflexible and illiquid as physical assets need to be sold to realise investments or until the fund ends

- Typically invested in traditional property types (office, industrial and retail), with office and retail being more exposed to disruption.

- High transaction costs

Listed property

- Liquid alternative to unlisted property investment, REITs are listed on equity markets

- Flexibility to move into different real estate sectors and regions

- Minimal transaction costs

- Greater transparency with tighter corporate governance regulation. Better corporate governance is generally correlated to increased investment outcomes

- Assets within the REIT universe provide access to alternative property sectors such as data centres, healthcare, residential and self-storage facilities

- Less volatile than equities, but more volatile than unlisted property funds (see charts in appendix)

- Natural inflation hedge (stable cash flows, pricing power)

Chart 1: Listed Property vs Unlisted Property Funds by asset type

Listed Property

- Convenience Retail Shopping Centres

- Medical Office Buildings

- Life Science Assets

- Apartments for Rent

- Detached Housing for Rent

- Land Lease Communities

- Student Accommodation

- Hotels and Leisure Assets

- Logistical Centres

- Data Centres

- Self-Storage Facilities

- Seniors Housing Assets

- Private Hospitals

- Shopping Malls

- Suburban Office Buildings

- CBD Office Buildings

Direct Property

- Office Buildings

- Retail Shopping Centres

- Industrial Warehousing

'We believe the argument for listed property is currently compelling'

With liquidity being a key attraction in markets with heightened volatility, the flexibility to move between property segments which may have different supply and demand dynamics and appealing valuations make the argument for listed property more compelling.

Understanding liquidity

As noted above, liquidity is an important consideration for investors. Within certain markets this has been a core issue during periods of volatility where private real estate funds have ‘gated’ their fund preventing investor redemptions.

The realisation that an unlisted property fund cannot instantly sell assets to meet redemption requests becomes a stark reality.

This is due to the complex nature of property transactions being inherently less liquid than funds that invest in more readily traded assets such as listed equities, listed property and bonds.

Listed Property – the attractions

With listed property offering investor’s liquid property exposure to high quality assets across many property subsectors, what other attractions does this asset class offer? There are several core characteristics of listed property that reinforce the ability to deliver resilient cash flows together with long-term capital appreciation:

- Dependable cash flow

REITS generate stable cash flows due to the revenues being derived from contracted rental income streams from a large array of property types.

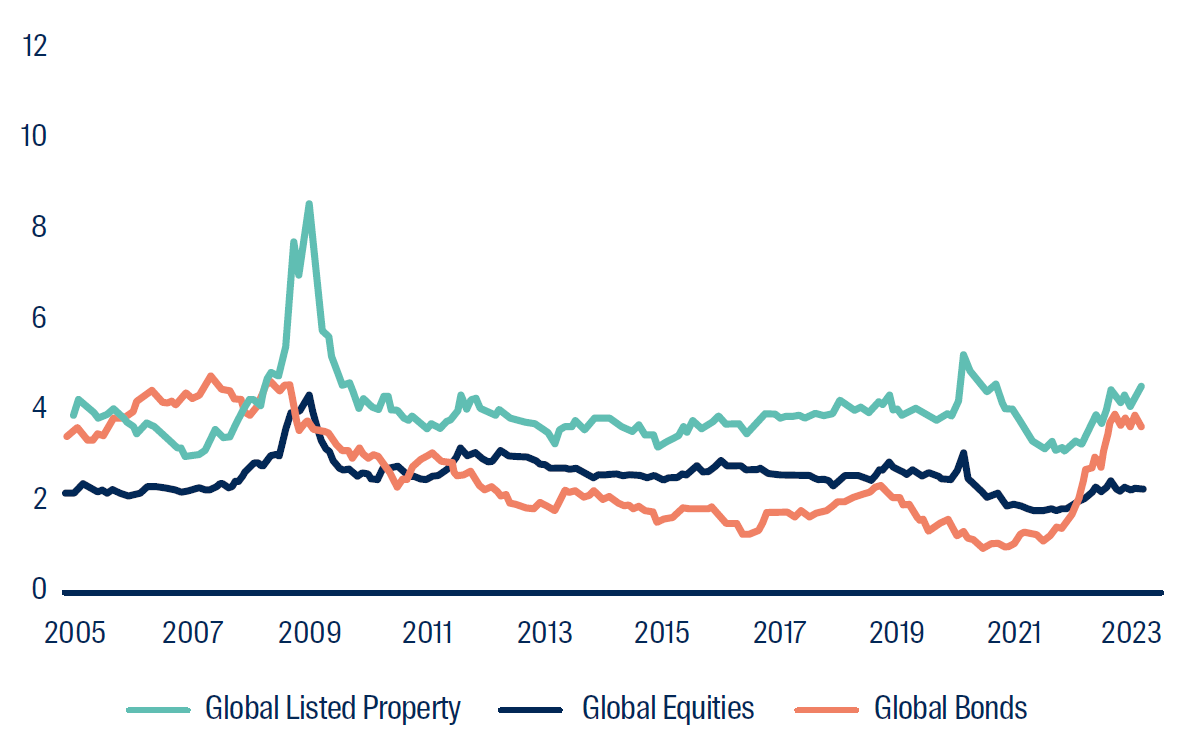

The stable cash flows allows the REITs to be able to continually provide attractive dividends to their shareholders through the cycle. This is demonstrated in Chart 2 below where Global Listed Properties dividend yields are shown to be generally higher than Global Bonds and Global Equities over time.

Disclaimer: Data as at 31 March 2023. Global Reits as represented by the FTSE EPRA Nareit Developed index. Global Equities as represented by the MSCI World index. Global Bonds as represented by Bloomberg Global Aggregate Bond Index. All data is in USD

- Leveraging growth

We believe listed property securities funds invest in higher quality assets and across multiple property types and regions that private funds may not have access to.

The asset diversity and quality pays dividends in generating capital growth within a listed property portfolio. The tenant base of a REIT often carries less risk than the overall property market, given the higher quality assets. Unlisted property funds often have relatively concentrated sector exposures and lack diversity and have greater tenant concentrations.

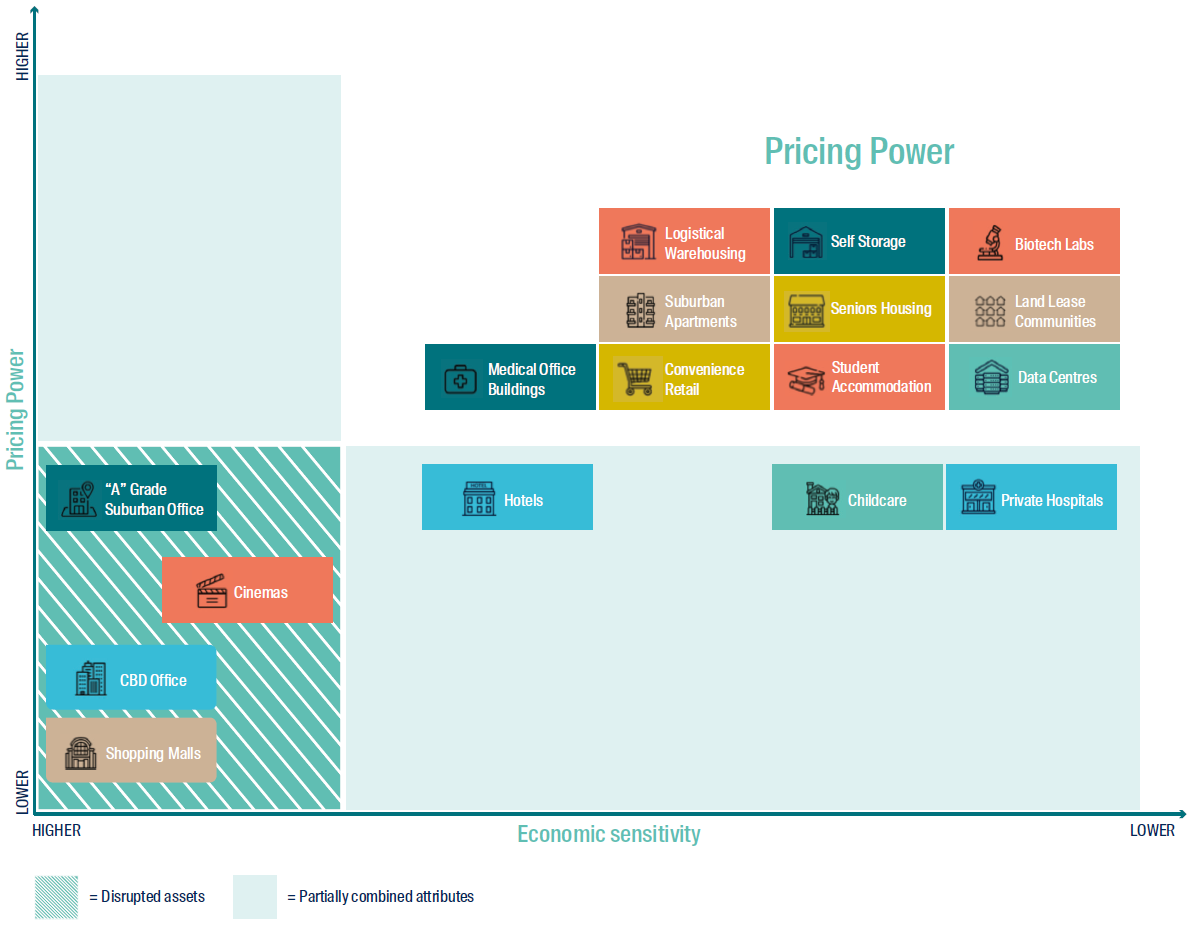

The asset types within the listed property universe such as biotech laboratories, data centres, student accommodation, self-storage facilities and logistics warehouses offer exposure to structural growth themes. These assets tend to have lower economic sensitivity with operating fundamentals driven by societal change, adoption of technology, growth in data consumption and the growth in pharmaceutical research and development etc. This is an important distinction between listed property and unlisted property funds, with listed property dividends consistently growing at a faster pace.

'Listed property offers exposure to high growth themes'

An inflation hedge?

Many property types offer an inflation hedge to investors.

- Some property types have built in clauses in their rental contracts that automatically increasing rents on an annual basis. These contracts can either be fixed in nature (usually c.2-3%) and/or tied to a published inflation rate or a mixture of both which may take pricing floors or caps into consideration. Over the shorter time periods these lease clauses assist in passing higher costs through to the tenants. However, for the inflationary hedge to be sustainable, the property requires pricing power. Without pricing power the inflationary hedge will not be sustainable and could lead to tenant default and/or material falls in rents at the end of the lease.

- Assets that are able to maintain ‘pricing power’ (Chart 3 below) will be able to pass through inflationary pressures to tenants, providing a natural sustainable inflationary hedge driving revenue growth. Rising inflation also increases the replacement cost of property assets and increases barriersto-entry, reducing supply. Limiting supply further underpins market rental growth and supports property valuations.

As shown in the chart below, the majority (+90%) of the listed property sectors assets sit in the top right quadrant, offering strong pricing power driving the inflationary hedge with low economic sensitivity.

Performance with rising interest rates?

Rising interest rates impact property valuations due to present value calculations. However, rising interest rates tend to be accompanied by rising inflation. Those assets with pricing power to capture the inflationary hedge will be far better placed to mitigate the valuation effect of higher interest rates. The direct property funds tend to be exposed to old world traditional assets such as office buildings and shopping malls. These assets are disrupted, they do not offer an inflationary hedge and have high economic sensitivity. It’s these assets that tend to experience the greatest valuation falls as interest rates increase and this has certainly been the case in the current cycle.

Chart 3: Pricing power within the Listed Property universe by asset type

Source: First Sentier Investors, for illustrative purposes only

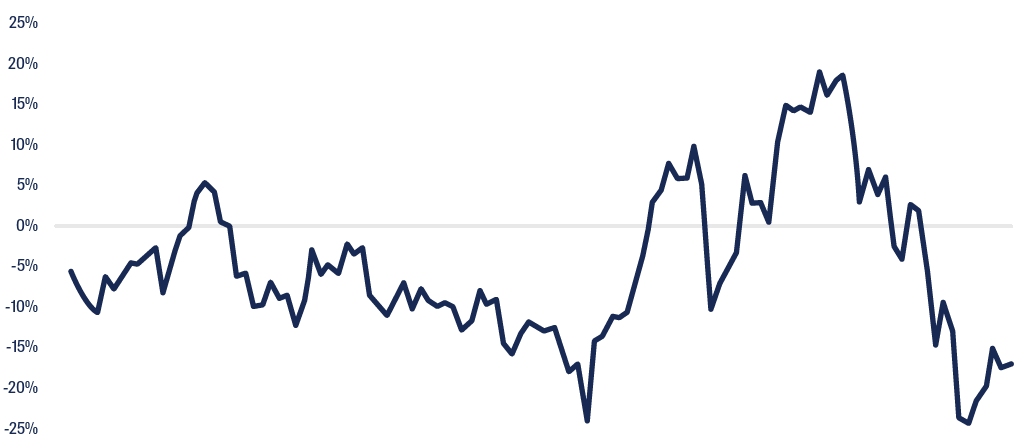

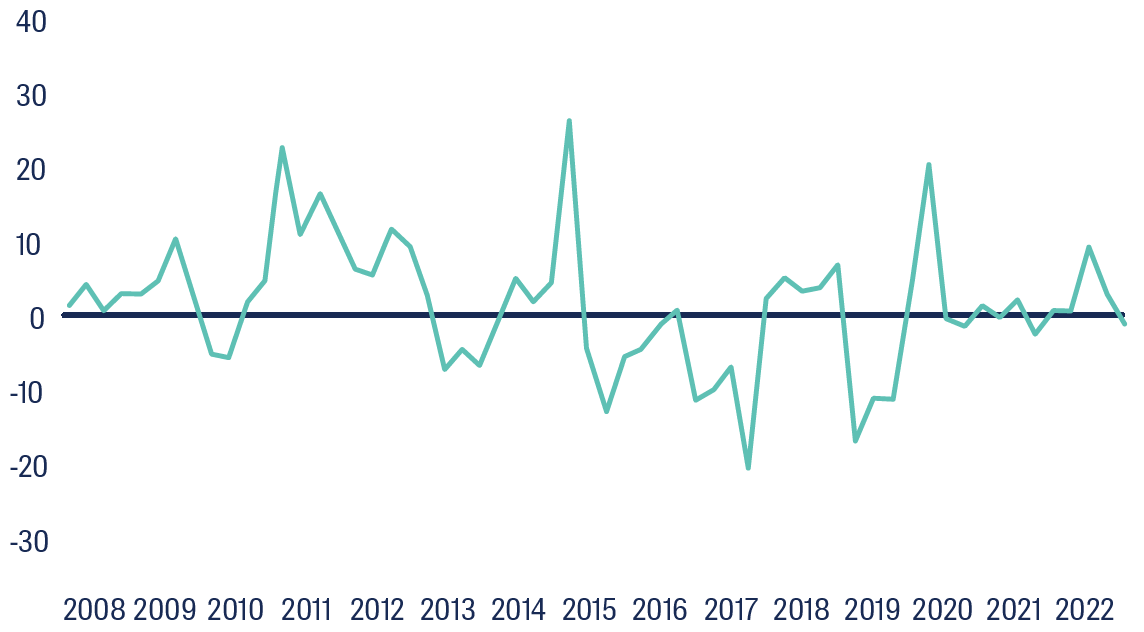

Chart 4: First Sentier Global Property Securities Fund Discount/premium to net asset value (NAV)

Disclaimer: Metrics are for the the First Sentier Wholesale Global Property Securities Fund. NAV (Net Asset Value) is our assessed value of property assets owned plus the value of other businesses operated. Past performance is not indicative of future performance. Data as at 31 March 2023. Source: First Sentier Investors

Conclusion

With financial markets adjusting to both higher interest rates and elevated inflation, it is not surprising many asset classes have experienced falling valuations. This has led to the First Sentier Global Property Securities Fund trading at a large valuation discount to unlisted property and also to its net asset value (Chart 4 above). With the Fund’s high asset quality, dependable inflation hedge and superior liquidity in conjunction with the current valuation dispersion, offers investors a compelling alternative to unlisted property funds.

Appendices

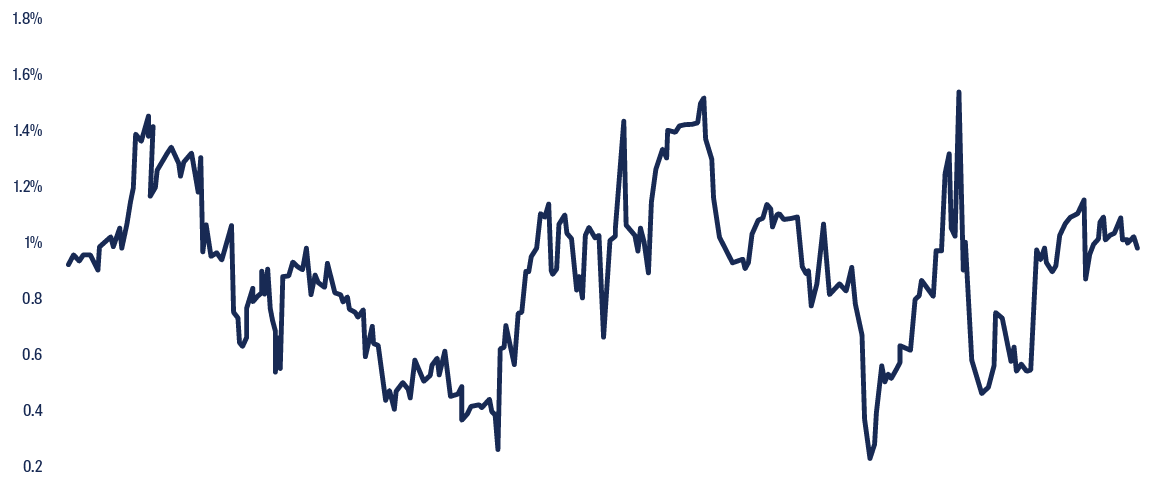

18 month Rolling Beta of Listed Property vs Equities (as at 31 March 2023)

Average 18-month rolling beta = 0.89

Disclaimer: 18 month rolling Beta of FTSE EPRA NAREIT Developed index vs MSCI world index. All performance data is in USD. Data from FTSE EPRA NAREIT Developed index inception date 31/01/1990 to 31 March 2023.

Source: First Sentier Investor

1 yr Rolling Beta Listed Property vs Direct Property

Chart 2: Dividend Yield (%) Over time

Disclaimer: FTSE EPRA NAREIT Developed Index vs INREV Global Real Estate Fund Index. All data in USD terms. Past performance is not indicative of future performance. Source: Factset and inrev.org. Data as at 31 December 2022

* Beta is a measure of the volatility of a security or portfolio compared to a market as a whole.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM) both which form part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

The product disclosure statement (PDS) or Information Memorandum (IM) (as applicable) for the First Sentier Global Property Securities Fund and ARSN 634 637 586 (Fund), issued by The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150) (Perpetual), should be considered before deciding whether to acquire or hold units in the Fund(s). The PDS or IM are available from First Sentier Investors. The target market determination (TMD) for the Fund is available from First Sentier Investors on its website and should be considered by prospective investors before any investment decision to ensure that investors form part of the target market.

MUFG, FSI AIM, their respective affiliates and any service provider to the Fund do not guarantee the performance of the Fund or the repayment of capital by the Fund. Investments in the Fund are not deposits or other liabilities of MUFG, FSI AIM, their respective affiliates or any service providers to the Fund and investment-type products are subject to investment risk including loss of income and capital invested.

Investors in managed accounts accessing strategies or portfolios mention in this material are not able to invest directly into such strategies or portfolios mentioned in this material (Portfolio).

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any past performance information provided reflects the performance of a Portfolio and not any individual managed account. Returns will differ for individual managed accounts compared to the Portfolio depending on matters such as inception date, fees and brokerage costs payable, adherence to model portfolio weights, portfolio implementation timing and fees payable. The past performance information does not take into account any taxes that may be payable in connection with any returns or gains made from any Portfolio.

Any performance information relating to Funds has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom