Summary

The First Sentier Wholesale Strategic Cash Fund (‘the Fund’) reported a positive return (0.0032 or 0.32%, gross of fees) for the month of October 2022. This result was a welcome development following the low interest rate environment of the last 2 years, which has seen cash as an asset class struggle to produce higher returns and gain interest. With inflation becoming a key focus globally, the Reserve Bank of Australia (RBA) has begun tightening monetary policy through hiking interest rates, which has seen increasingly positive prospective returns from cash portfolios. The Fund maintains ample liquidity and is well positioned to capitalise off of the current market conditions. This note will dive into the dominant factors driving performance as well as further detail of the investment team’s longstanding approach to managing the portfolio which remains unchanged.

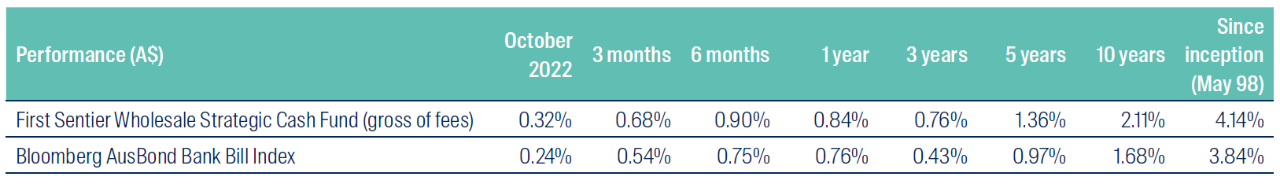

Source: First Sentier Investors, data as at 31 October 2022. Performance numbers longer than one year are annualised. Past performance is not indicative of future performance.

Note: The Unit price or Net Asset Value (NAV) for the Fund is not fixed. Unit Prices are calculated by dividing the value of the Fund’s net assets by the number of Units on issue, less an allowance for buy-sell spread transaction charges, which remain nil for the Fund. Therefore, every day the Unit Price of the Fund rises or falls in line with the daily market valuation of the underlying assets.

To summarise, the two key drivers of performance leading to increased returns for the Fund over the month were: 1) higher yielding returns from Negotiable Certificates of Deposit (NCD’s) which have risen throughout 2022 in line with the higher cash rate; and 2) an increase in the Fund’s running yield as a result of the higher trading margins being received by the Fund’s holdings in Residential Mortgage-Backed Securities (RMBS).

Cash rate

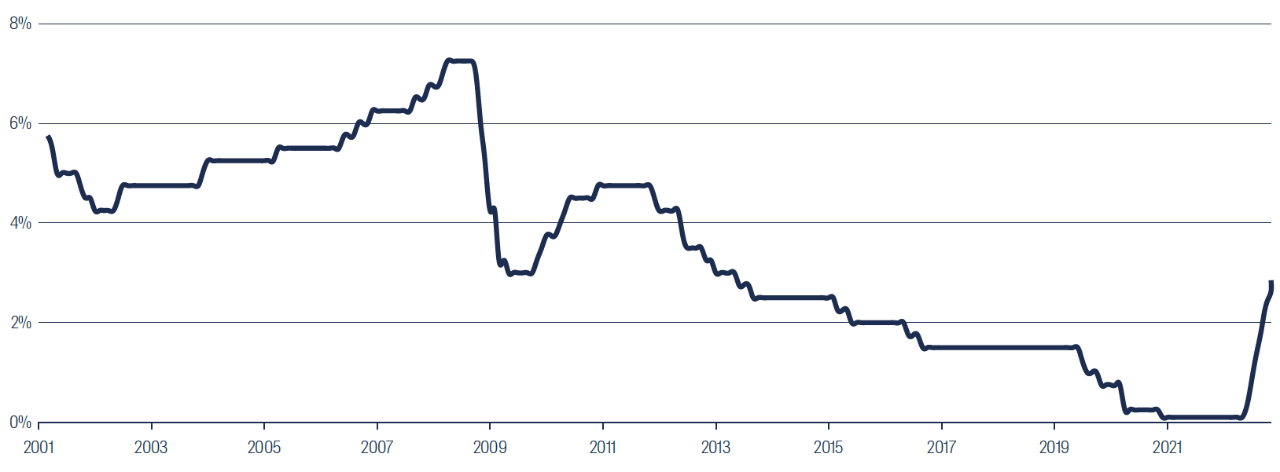

One of the primary variables that impacts the Fund’s performance is the underlying cash rate in Australia, set by the RBA. On the 3rd of November 2020, RBA officials lowered the target cash rate to the lowest rate recorded in history, 0.10%. The Board decided to keep the cash rate at this level for the next 18 months, at which point they deemed it the right time to begin withdrawing some of the extraordinary monetary support they instigated to help the Australian economy through the pandemic. Since then the rate has increased incrementally to 2.85% as at 2nd November 2022, with consensus forecasts currently suggesting interest rates could peak at around 4% in 2023.

Inflation is increasing globally, driven by steady demand, supply chain disruptions and shortages as well as the impact from fiscal spending as a result of the Covid-19 pandemic. Headline inflation in Australia climbed 1.8% in Q3 2022 and to an annual pace of 7.3%, the highest level seen for more than 30 years and well above the RBA’s 2-3% target range. This rise in inflation is considered to be broadly based, with food and new dwelling prices to be recent stand out drivers. Strong domestic demand is anticipated to continue, hence inflation is forecasted to peak at around 8% later this year. Due to these high levels, the RBA has continued to aggressively raise interest rates (see chart below).

The benchmark of the Fund (Bloomberg AusBond Bank Bill Index or ‘Bank Bills’) is typically slightly higher than the risk free cash rate. Although highly correlated, Bank Bills is a more appropriate benchmark than the cash rate as this is essentially the key reference rate used for the pricing and valuation of money market securities in Australia. As the cash rate is rising, this has resulted in higher bank bill yields, which are feeding into improved monthly returns for the Fund. The running yield of the Fund is determined both by expected moves in monetary policy and the steepness at the short end of the yield curve.

Reserve Bank of Australia ('RBA') Cash Rate Target (%)

Source: Reserve Bank of Australia, Bloomberg as at 2 November 2022

Mark-to-market valuation changes

The First Sentier Wholesale Strategic Cash Fund’s portfolio composition and construction has been designed specifically to handle stressed market environments such as this to ensure capital preservation and liquidity. Specifically, the Fund managers think about the portfolio in two separate buckets: 1) liquidity component; and 2) income component.

1) Liquidity component

The ‘liquidity component’ of the Fund includes securities and deposits that can be converted to cash within 24 hours to immediately facilitate client cash flow requirements (settlement T+1). A majority of the Fund (typically >50%) is held as part of this ‘liquidity component.’ Specifically, this currently includes Negotiable Certificates of Deposit (or NCDs), Convertible Deposit Accounts, and Cash/Deposits. The current weight and definition of each of these is shown below:

- Negotiable Certificates of Deposits (42%):

Deposit securities, issued by authorised deposit-taking institutions (ADIs) which can be traded on the secondary market. Each NCD is issued for a specific term, typically under six months and can be sold in one day. These instruments are considered the most liquid within the Australian money market universe. - Convertible Deposit Accounts (10%):

Deposits with a pre-specified term or maturity date negotiated directly with Australian banks which can be readily converted to NCDs with one day’s notice. Following conversion to NCDs, these trade on the secondary market and can be liquidated immediately. - Cash/Deposits (0%):

Australian dollars in a bank or custodian account held for transactional purposes.

Given this ‘liquidity component’ bucket only includes instruments that can be readily converted to cash, the daily pricing impact is negligible on holdings in this category and mainly reflects the ongoing accrual of interest earned. The team manage the interest rate risk (or duration) of these holdings based on their expectations of future interest rates to generate excess returns although the primary goal of this bucket remains capital preservation and liquidity.

2) Income component

As part of the investment team’s active management approach, the Fund aims to generate a return above the index by taking incremental term and credit risk while managing those risks prudently. This part of the portfolio is considered the ‘income component.’ Since the Fund must be able to facilitate large daily transactions, the portfolio managers typically limit the ‘income component’ to 40-50% of total assets held. This includes term deposits and credit-based instruments, such as highly-rated floating rate notes (‘FRNs’).

- Term Deposits (TDs) (24%):

TDs are a type of deposit with a set term maturity (in this case all less than 90 days) and structured for maturities to take place on a rolling basis every two weeks. Upon maturity, they can be reinitiated/rolled or moved into ‘liquidity component’ assets. The attractiveness of TD’s is that banks are prepared to pay a margin in excess of an equivalent NCD. Hence a slight give-up in liquidity can contribute significantly to portfolio performance due to the higher rates that TD’s are invested at. Wholesale TD’s are typically not able to be broken without penalty, if at all. - Credit-based securities – FRNs including RMBS (24%):

A floating-rate note (‘FRN’) is a debt instrument with a variable interest rate. In Australia, most FRNs pay income set at a margin over Bank Bills and once issued they then trade in the secondary market. Simply put, when interest rates go up, the income generated from FRNs increases and when interest rates go down, the income generated from FRNs decreases. However, the most important factor that will cause changes to the price of an FRN is the movement in the traded margin or credit spread. Since FRNs can be backed by various types of issuers and collateral (e.g. Major Banks, Regional Banks, Australian Corporates, Offshore Corporates, Pools of Mortgages, etc.), the pricing of FRNs varies depending on perceived credit worthiness in the market.

While the Fund has historically held a variety of these securities such as Big-4 Bank FRNs, currently the Fund only owns Australian residential mortgage-backed securities (‘RMBS’) in this category. The portfolio management team believe AAA RMBS securities offer better value-for-risk relative to these other credit-sensitive short duration instruments. The key feature of asset-backed FRNs such as these structures is ‘tranching’, which transforms the mortgage pool into a range of securities (RMBS notes), each with a different risk and maturity profile.

The Fund currently invests only in the highest tranches of these securities to ensure a level of credit enhancement required to achieve an AAA credit rating. Given the bespoke nature of these securities and limited liquidity available in the secondary market, the portfolio management team typically purchase these securities on a buy-and-hold basis, fully expecting to hold to maturity. Due to their seniority in the capital structure (i.e. structural subordination) and other features of the pools of mortgages which we are investing (e.g. seasoning of loans, LVR levels, lenders’ mortgage insurance protection, etc.), the investment team have strong confidence in our AAA rating of each and every security held.

To be clear, the team rarely sell any RMBS securities in the Fund. During October there were some selling pressure in the RMBS sector, following developments offshore. The mini-budget announced in the UK in late September resulted in a sharp sell-off in the gilt market and, in turn, liability-driven investors (insurance companies and pension funds) faced margin calls and were required to raise cash. Some of this was raised through sales of equities and credit, but about $2 billion of Australian RMBS was sold during October too. Encouragingly, most of the offers were cleared close to revaluation levels. Overall, we remain comfortable with the structure and performance of the Fund’s RMBS exposures. Higher mortgage rates will almost certainly result in an increase in arrears eventually, although performance to date has been excellent with no meaningful signs of deterioration. Generally, household balance sheets appear well-positioned, but we are watching for any signs of developing stress. Either way, in our opinion, careful security selection means the portfolio is well positioned for any asset deterioration that may occur in the future.

Fund positioning

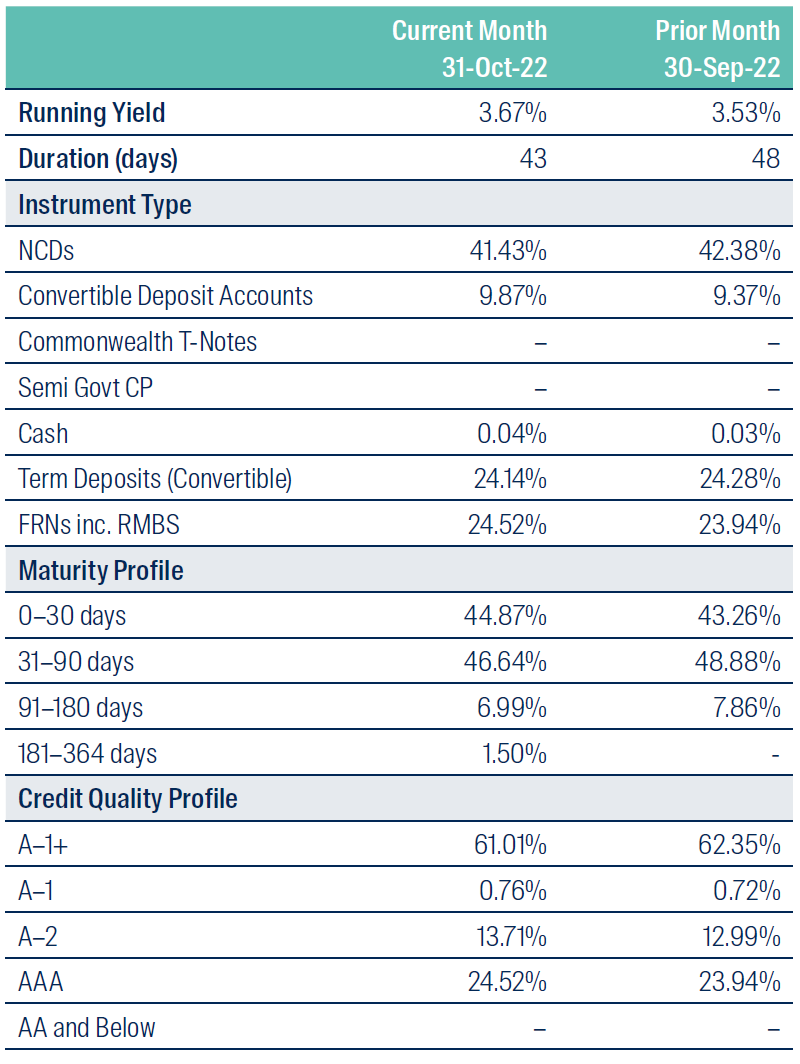

Fund positioning as at end of current month (October 2022) and prior month (September 2022):

Source: First Sentier Investors, as at 30 September 2022 and 31 October 2022

Conclusion

During times of volatile market environments, investors expect their cash allocation to provide liquidity and capital preservation. The investment team remain confident the Fund remains well placed to provide both of these key features and has not changed its approach which has served investors well for 20+ years. With further interest rate hikes expected to combat rising inflation, this has a direct effect on the prospective returns available from the Fund. In order to minimise risk there remains a focus on the quality of all securities held in the portfolio. All are AUD-denominated, and are highly rated by ratings agencies as well as our own internal credit analysts.

Operating across a number of market environments for more than 30 years, our Short Term Investments team, led by Tony Togher, has the largest number of dedicated portfolio managers of cash funds in Australia and remains the largest Cash manager in the country with roughly $47 billion in funds under management as at the end of October 2022. Along with providing liquidity and capital preservation, the experienced investment team aims to also deliver return enhancement as investment opportunities present themselves in the periods ahead. The team will seek to provide further Fund updates as market conditions unfold.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

The product disclosure statement (PDS) or Information Memorandum (IM) (as applicable) for the First Sentier Wholesale Strategic Cash Fund, ARSN 087 558 674, issued by Colonial First State Investments Limited (ABN 98 002 348 352, AFSL 232468) (CFSIL), should be considered before deciding whether to acquire or hold units in the Fund(s). The PDS or IM are available from First Sentier Investors.

MUFG, FSI AIM, their respective affiliates and any service provider to the Fund do not guarantee the performance of the Fund or the repayment of capital by the Fund. Investments in the Fund are not deposits or other liabilities of MUFG, FSI AIM, their respective affiliates or any service providers to the Fund and investment-type products are subject to investment risk including loss of income and capital invested.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information is gross performance and does not take into account any ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom