SCAMMER ALERT

Please be aware of scammers falsely impersonating FSI representatives about potential investments. FSI representatives do not make direct contact with prospective individual investors. An individual contacting you, claiming to represent FSI, is not a legitimate approach. Find out more about combating investment scams.

At AlbaCore, we focus on the long-term. As one of Europe’s leading alternative credit specialists, we invest in private capital solutions, opportunistic and dislocated credit, and structured products.

Discover moreInvestment strategies

Insights

Specialist in Asia Pacific, Japan, China, India and South East Asia and Global Emerging Market equities.

Discover more

Leader in active quantitative equities across Australian equities, global equities, emerging markets and global small companies.

Backed by a unique blend of research, portfolio construction and risk management, focused on uncovering original insights and translating them into investment strategies that are active and systematic, aiming to generate alpha.

Discover moreInvestment strategies

Insights

Specialists in equity portfolios in Asia Pacific, emerging markets, global and sustainable investment strategies

Discover moreResponsible investment

Responsible investment

Mark Steinberg

CEO of First Sentier Investors

Responsible investment principles underpin our investment approach

To contribute to a sustainable economy and society, we seek to collaborate with our clients, competitors and broader stakeholders.

We do this by participating in industry forums, actively engaging with investee companies, regulators and policy makers, and publishing thought leadership.

We are currently focused on the following four key issues: climate change, human rights and modern slavery, diversity, and nature and biodiversity.

Our net zero journey

We believe that society must drastically reduce greenhouse gas emissions if we are to avoid the worst consequences of the climate crisis. It has become obvious that immediate climate action is needed in order to meet the Paris Agreement’s goal of limiting rises in global temperature to 1.5 degrees Celsius.

The individual and collective decisions we make as active investors can influence the nature and speed of this transition.

Building a better future

We have the opportunity and responsibility to allocate our clients’ capital in a way that drives positive social and environmental outcomes within the context of our investment strategies.

We have developed a range of tools to address some of the issues we face as investors, which enable our investment teams to confidently engage with companies, in search of tangible outcomes.

Digging deeper

Every investment decision can be associated with a set of ESG risks and opportunities, which may present large and complex problems to address.

We cannot solve these issues alone.

We strive to collaborate with clients, peers, policymakers and broader stakeholders so that we can learn from each other, set consistent expectations and leverage our collective resources to tackle these issues.

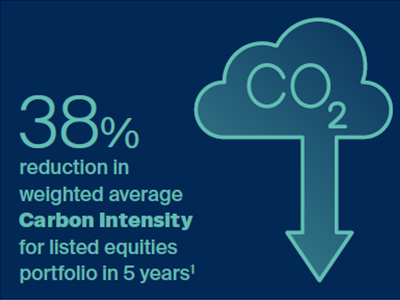

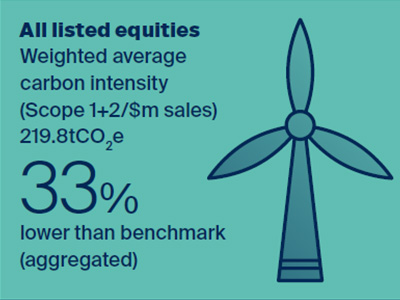

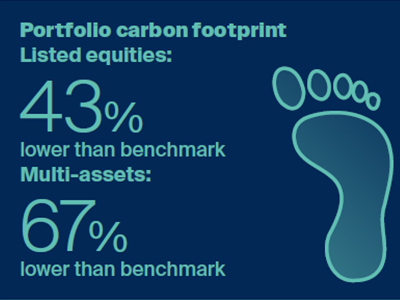

A snapshot of our progress

1. 31 Dec 2017 – 31 Dec 2022

The data set out above are estimates based on data sourced by First Sentier Investors. This data is current as at 31/12/2022. It is based on information and representations sourced from third parties (including portfolio companies), which may ultimately prove to be inaccurate. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this data and no reliance should be placed on it by any third party. Calculations for Multi-Asset Solutions are for objective based funds only.

Discover our reports

Read our latest annual

Responsible Investment Report

Read our latest annual

Stewardship Report

As long-term investors, we know that the decisions we make impact communities today, tomorrow and years from now. Responsible investment and stewardship are at the core of how we operate as a business and allocate capital, and we are committed to transparency and accountability regarding our performance in this area.

1. Ernst & Young was engaged by First Sentier Investors’ Global Property Securities team to undertake ‘limited assurance’ as defined by International Auditing Standards, over First Sentier Investor’s Portfolio Operational Carbon Emissions (Scope 1 and 2) Forecast to Net Zero for the year ended 30 June 2021. Based on the review, Ernst & Young determined the forecast was prepared and presented fairly, in all material respects, in accordance with the defined Criteria.

2. NIRAS-LTS research for Stewart Investors.

The commitments and targets set out on this website are current as of today’s date. They have been formulated by the relevant First Sentier Investors (FSI) investment team in accordance with either internally developed proprietary frameworks or are otherwise, based on the Institutional Investors Group on Climate Change’s (IIGCC) Paris Aligned Investment Initiative framework. The commitments and targets are based on information and representations made to the relevant investment teams by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of these commitments and targets set out on this website depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. FSI will report on progress made towards achieving these targets on an annual basis in its Climate Change Action Plan. The commitments and targets set out on this website are continuously reviewed by the relevant investment teams and subject to change without notice.

Keep up to date with our latest research and developments on social media, or subscribe to our email newsletter

First Sentier Investors became a Certified B Corporation in November 2022 with a score = 107.2, noting that the passing score is 80. Please visit the B Corp Directory to view our report and for additional information regarding the assessment process.

Copyright © First Sentier Investors (Australia) Services Pty Ltd 2024, (part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc MUFG.)

In the EU: This is a marketing communication. The fund(s) mentioned here may or may not be registered for marketing to investors in your location. If registered, marketing may cease or be terminated in accordance with the terms of the EU Cross Border Distribution Framework. Copies of the prospectus (in English and German) and key investor information documents in English, German, French, Danish, Spanish, Swedish, Italian, Dutch, Icelandic and Norwegian, along with a summary of investors' rights are available free of charge at firstsentierinvestors.com

Get the right experience for you

Your location :  United Kingdom

United Kingdom

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan