In April 2019, we published an article titled “China’s Inclusion in the Bloomberg Barclay’s Global Aggregate Index” where we discussed the implications of such a move.

In April 2019, we published an article titled “China’s Inclusion in the Bloomberg Barclay’s Global Aggregate Index” where we discussed the implications of such a move. Just a year later and a lot has changed in the world and some of the points made in the research piece last year are worth revisiting.

Foreign participation

We anticipated last year that foreign flows into the Chinese bond market (for Government Bonds and the highest quality credit issuers denominated in CNY) could be in the region of USD 120 – USD 150 bn equivalent over the following two years. Just a year later and flows are in excess of over USD 350 bn1 , easily surpassing our own estimates.

1 Source: https://www.chinabondconnect.com/en/Data/Market-Data.html

Foreign inflows into China’s bond market

Source: Bond Connect Company; First State, as of June 2020. USD:CNY=7.004

Foreign flows have been supported by inclusion into key benchmarks (namely JPMorgan and Bloomberg) for Chinese bonds at a time when the amount of bonds on issue in China’s bond market is growing at around 19.9% per annum and today it stands at RMB 94 trillion2 in size. The Chinese bond market has in 2019 surpassed Japan as the second largest bond market in the world. With growth of supply comes liquidity and diversity (in credit issuers).

2 Source: CDCC and SHCH, as at June 2020

Time frame for other key benchmarks to include Chinese bond

Global markets are closely watching when China bond will be included by one further key index provider, namely “FTSE Russell - for its FTSE World Global Government Bond Index (“WGBI”)” which has over USD 2.5 trillion tracking funds. The FTSE Russell inclusion was expected late 2019 and it was announced at the height of trade war tensions that it was not to be included. With the other key benchmark competitors to WGBI (JPMorgan and Bloomberg) having already added China, we would anticipate before year end 2020 to see further announcements from FTSE Russell.

With increased foreign investors’ participation, it would move China’s bond market closer to international standard in terms of investor mentality, market infrastructure, risk management practice, sell-side market making capability, etc. For example, allowing Standard and Poor’s to set up a fully owned subsidiary in China would help China’s credit market to evolve closer to international standard.

In addition, with a shrinking current account surplus, an increase in portfolio inflows would help China to build the capital account buffer, and give support to the currency.

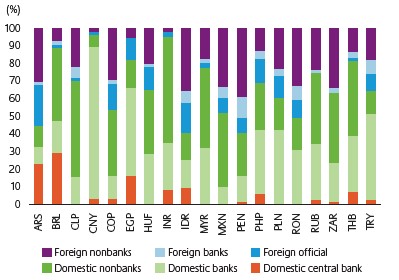

Yet, despite the pace at which foreign firms are getting operationally ready (over 1,000 firms now approved) to invest onshore in China, according to data compiled by the IMF and HSBC foreign investors remain under-invested in China bonds with domestic banks dominating.

Source: IMF, HSBC

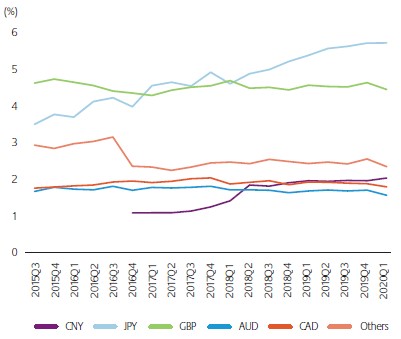

This under-investment in the Chinese bond market comes at a time when the RMB is fast becoming an important global currency. Governments / Central Banks globally are steadily increasing their allocations to RMB. RMB as a share of FX reserves recently overtook the Australian and Canadian dollars in its share (see chart “Share of Total FX Reserves”), pointing to more trade activities in the currency and more of the currency looking for somewhere to invest.

Share of total FX reserves

Source: IMF as at 31 March 2020

Challenges and opportunities for investors

Like investing in anything new for the first time, the challenge will be in figuring out the system, players, process, risks and costs. More importantly, the governing bodies on the issuer side are also figuring out the steps and requirements of foreign investors whilst maintaining their goals with respect to movement of capital. Ongoing steps that were continually taken by the regulator have dealt with many of the challenges. This has been done via a high level of engagement with the various market participants.

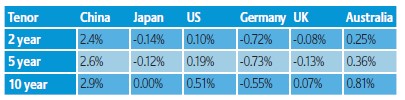

The opportunities are in seeking returns from what is now the second largest bond market in the world. When we compare yield levels today to their developed world peers, China stands alone in offering investors yield at a time when there is little to negative yields elsewhere. What is important to note is recent comments from the Chinese central bank that questioned whether zero or negative interest rates actually helped or harmed the economies of the west.

Source: Bloomberg 5 August 2020

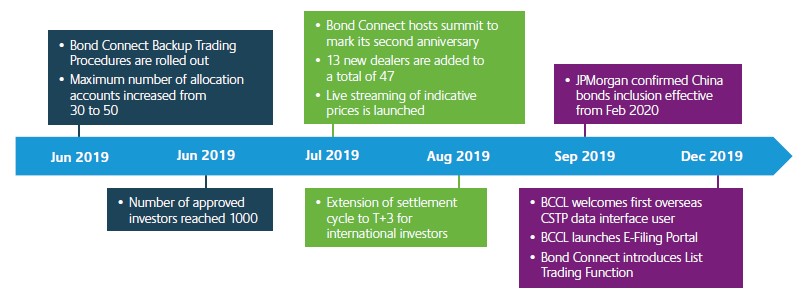

Key bond market and regulatory development since April 2019

Source: https://www.chinabondconnect.com/en/About-Us/Milestones.html

Conclusion

The opening up in China is one of the three most significant events in global bond markets over the last 20 years. The other two being the introduction of the Euro and Quantitative Easing in the US. As we began 2019 we felt we were potentially coming to the end of the negative yielding world that we lived in post 2008. The onset of COVID19 and the impact it has had on government finances globally reset us for another decade of negative yields. This makes Chinese bonds a very attractive addition to your portfolio.

Important Information

The information contained within this document is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First State Investments (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. Neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this document.

This document has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this document without obtaining specific professional advice. The information in this document may not be reproduced in whole or in part or circulated without the prior consent of FSI. This document shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First State Investments’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this document is issued by First State Investments (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First State Investments (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First State Investments is a business name of First State Investments (Hong Kong) Limited. First State Investments (registration number 53236800B) is a business division of First State Investments (Singapore). The First State Investments logo is a trademark of the Commonwealth Bank of Australia or an affiliate thereof and is used by FSI under licence.

First State Investments (Hong Kong) Limited and First State Investments (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions, operating in Australia as First Sentier Investors and as FSI elsewhere.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom