Prices & performance

Show fund factsheets & data

Strategy Overview

Key Facts

Exit Price:

Price Date:

Issuer:

* This is an annualised interest rate from the past seven days. For actual performance for our Cash Funds, please view the performance page.

Issuer:

Strategy Overview

Key Facts

This is no ordinary team.

Short term investments and cash funds have evolved over the past four decades. The rising interest rate environment has boosted the return prospects for the asset class.

Through time our approach has also evolved – our success lies in continuous innovation.

Why invest with us?

We manage a range of strategies, all of which provide a high level of liquidity and capital preservation. We also have a proven ability to tailor bespoke, segregated mandates according to client requirements.

A proven investment process is employed, which has consistently delivered favourable performance across market cycles.

With more than A$52 billion of funds under management, we are Australia’s largest cash manager. Unlike in many other asset classes, size and scale within cash is often a significant advantage.

Credit analysts complete comprehensive analysis of credit risk associated with all securities held, incorporating an assessment ESG risks.

Operating for more than 35 years, First Sentier Investors boasts one of the largest number of dedicated portfolio managers of cash funds in Australia.

Tony Togher

Head of Fixed Income, Short Term Investments and Global Credit

The evolution of cash markets

Some might remember the RBA cash interest rates being 18% thirty years ago and the unpredictability of central bank policy around that time. In contrast, the Covid-19 pandemic saw the RBA significantly ease Australian monetary policy, lowering the cash rate to 0.10%- the lowest it has ever been.

Inflationary pressures started to emerge and over the course of 2022 these pressures have accelerated, both in Australia and offshore. Central Banks globally have responded to the challenges posed by increasing inflation by aggressively hiking interest rates. The RBA began tightening monetary policy in May 2022, and have raised the cash rate 13 times since, now sitting at 4.35% in December 2023. This has seen an improvement in the prospective returns from Cash portfolios as short-dated money market securities produce higher yields.

Managing portfolios effectively through long-term market cycles requires an investment style that’s flexible enough to evolve with the market itself.

Cash never goes out of style

The right exposure to cash within a diversified investment portfolio depends on an investors’ time horizon and their reasons for holding cash within a broader investment mix.

Investors able to forecast their cash flow requirements typically allocate strategically to higher yielding, income-style investment options.

Get more from a cash exposure

Cyclically, the case for cash is dependent on the relative value of other asset classes.

Because the investment profile of cash is unlikely to change significantly over any given 12 month period, the use of cash reflects investors’ short-term risk appetite and expected returns elsewhere.

The value of active management

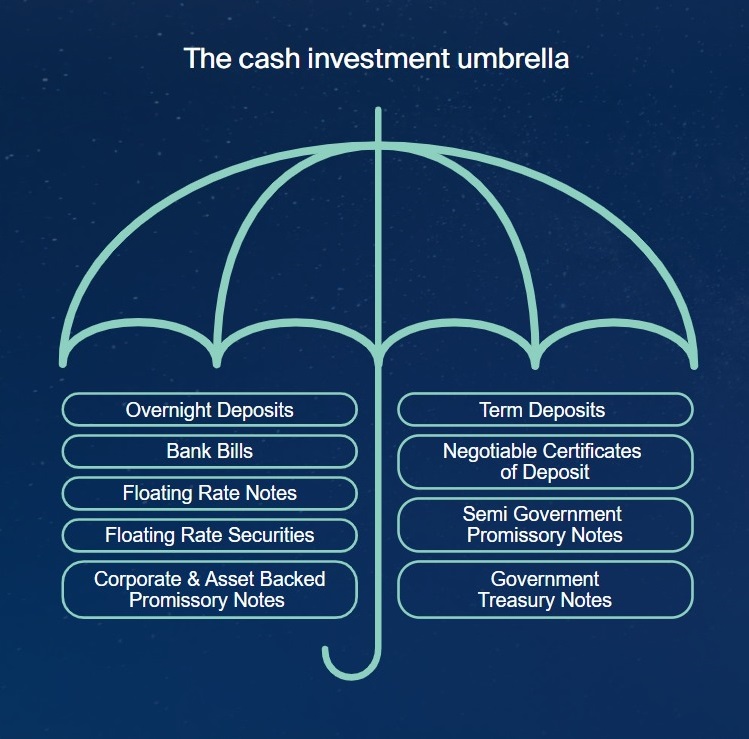

All of these security types carry some level of investment risk. It isn’t possible to eliminate these risks completely, but they can be mitigated through active duration management, in-depth credit research, portfolio diversification and ongoing monitoring.

Target consistent outperformance

The most important thing to bear in mind is that expected returns adequately compensate investors for the risks. We believe managing this trade-off using a proven investment process flexible enough to respond to structural shifts in the market can help generate consistent outperformance over the short, medium and long term.

Tony Togher

Head of Fixed Income, Short Term Investments and Global Credit

Nicholas Deppeler

Senior Portfolio Manager

Meet Tony Togher

This early bird has been to the gym and digested the overnight market news hours before Australian markets have opened. Tony Togher explains his morning routine and why discipline is important for investors.

Meet the investment team

Tony Togher

Nicholas Deppeler

Natasha Feder

Martin Ross

Read our latest insights

Want to know more?

Contact your Relationship Manager

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom