With more than 25 years’ experience managing global credit strategies we understand the importance of Environmental, Social and Governance (ESG) issues. We have been embedding an assessment of ESG-related risks in our Global Credit investment process for more than 15 years, since we became a signatory to the PRI. Recognising the growing appetite for sustainable solutions among responsible investors worldwide, we are excited the launch the First Sentier Global Credit Sustainable Climate Strategy. The strategy invests primarily in a diversified portfolio of global credit securities, while additionally seeking to make a positive contribution to climate change by investing in credit securities that contribute to climate changes mitigation, environmental protection, and/or a net zero economy.

Case study: Owens Corning

Summary

- Headquartered in the US, Owens Corning produces residential and commercial building materials and offers these globally to various industries.

- Owens Corning is divided into three business segments: Insulation, Roofing and Composites.

Why does this investment belong in the strategy?

- The company operates in a sector that has a significant impact on climate change and carbon emissions.

- For most companies in the building materials industry emissions and waste are key issues, but we believe Owens Corning has implemented strong management policies to tackle these issues. The company also has ambitious, SBTi-verified plans in place to achieve its net zero commitments.

- Further, Owens Corning manufactures insulation products, which we believe can directly impact and enhance the greening of buildings. These products typically reduce household energy consumption and the need for heating/cooling.

- The company has ambitious targets in place across a variety of environmental issues, which can be further explored in its Sustainability report, including:

- Increasing energy efficiency and moving to 100% renewable energy, combating climate change

- Circular economy, waste management.

- Protecting biodiversity, air quality management.

Expected contributions

- Owens Corning recognises the importance of taking action to mitigate the impacts of climate change through improving energy efficiency, increasing its use of renewable energy, and reducing greenhouse gas emissions.

- The company has been working with Ohio State University to evaluate efforts in assessing the resiliency of current strategies against a range of climate-related scenarios and time horizons. Initial focus has been on physical climate risks posed to its various locations, and potential impacts of climate change and severe weather activity on demand for the company’s roofing products.

Emissions Exposure (tCO2e)

Carbon Intensity (tCO2e/USD)

Source: First Sentier Investors, Owens Corning as at 31 December 2023

Case study: Iberdrola

Summary

- Headquartered in Spain, Iberdrola is one of the world’s largest utilities, with electric utility operations in almost 40 countries.

- Iberdrola is a leader in renewable energy generation, which supports its business profile in an environment focused on energy transition.

Why does this investment belong in the strategy?

- Green bonds issued by Iberdrola fund renewable energy projects. This bond was initially offered in February 2021. Specifically, the proceeds from the green bond have been put towards two offshore wind projects: Saint-Brieuc in France and Baltic Eagle in Germany.

- The funding of these projects aligns to our sustainable objective of climate change mitigation by making more renewable energy available to users.

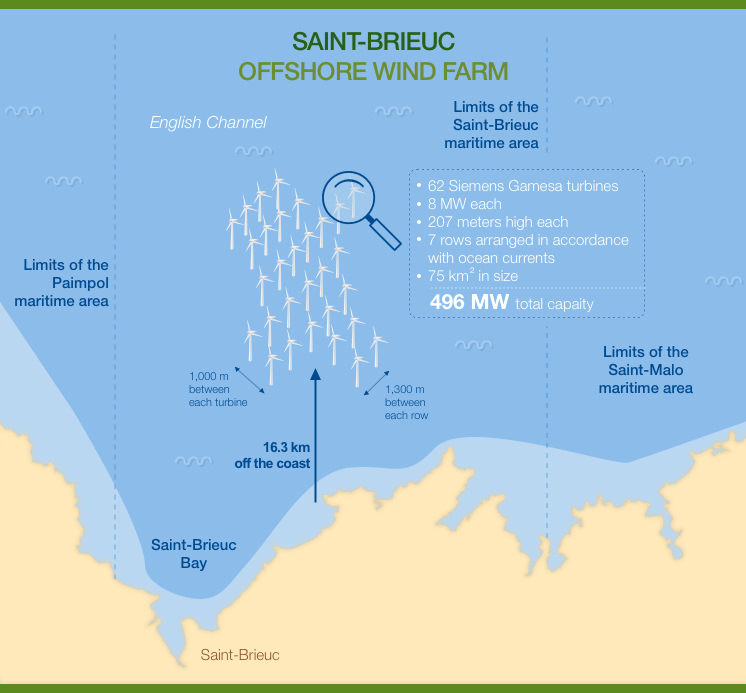

Project 1: Saint-Brieuc

- Saint-Brieuc was Iberdrola’s first large scale offshore wind power project in Brittany, France. It has been built with a total installed capacity of 496 megawatts, capable of generating enough clean energy for 835,000 people, according to Iberdrola.

- Building an offshore wind farm in this region has its benefits, as Brittany is prone to strong winds and high tides.

Project 2: Baltic Eagle

- Baltic Eagle is Iberdrola’s second major offshore wind power project in the Baltic. It is located 30 kms to the northeast of Rugen island, off the coast of northern Germany. Construction commenced in 2022 and is expected to be completed by the end of 2024.

- According to Iberdrola, the 476 megawatt installation will supply renewable energy to 475,000 households.

Emissions Exposure (tCO2e)

Carbon Intensity (tCO2e/USD)

Source: First Sentier Investors, Iberdrola as at 31 December 2023.

Global Credit Sustainable Climate Strategy, Craig Morabito, Senior Portfolio Manager

Meet the investment team

Tony Togher

Craig Morabito

Ben Samuel

Ky Van Tang

Want to know more?

More information about the Global Credit Sustainable Climate Strategy

Get the right experience for you

Your location :  Netherlands

Netherlands

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom